Creating a stronger financial future for every generation

For families walking a financial tightrope, unable to save for college, a home, or retirement, United Way Southwest Louisiana is here to help.

United Way Southwest Louisiana's Financial Security impact area empowers individuals and families to build a more stable economic future. By offering essential resources such as financial literacy programs, budgeting workshops, and access to job training, they aim to enhance the community's economic well-being. Their Initiatives support individuals in gaining the skills and knowledge needed to make informed financial decisions, ultimately helping to break the cycle of poverty. Through collaborations with local agencies and organizations, United Way is dedicated to fostering an environment where every generation can achieve financial independence and security, paving the way for a stronger, more resilient community.

OUR GOAL

Equip individuals and families with knowledge and skills necessary to move to or stay above the ALICE Threshold

OUR FOCUS

Building financial stability and strength

OUR PRIORITY AREAS

- Adult Education, Job Training & Career Pathways

- Financial Education & Coaching

- Homelessness Prevention & Intervention

OUR FINANCIAL SECURITY INITIATIVES

United Way Southwest Louisiana can initiate projects independently in each of our four impact areas. These Initiatives address important community needs that we have identified as critical. They can be used to address emergency needs during natural disasters, or critical community needs not being met by our partner agencies.

Our Funded Partner Agencies

These partners serve the community with programs in Financial Security.

- Assist Agency

- Beauregard Community Concerns

- Catholic Charities of SWLA

- Holy Ground Homeless Outreach GIM

- Jeff Davis CADA

- Literacy Council of SWLA

- New Covenant Faith Community Development

- Oasis A Safe Haven

- Project Build A Future

- The Salvation Army

- SWLA Law Center

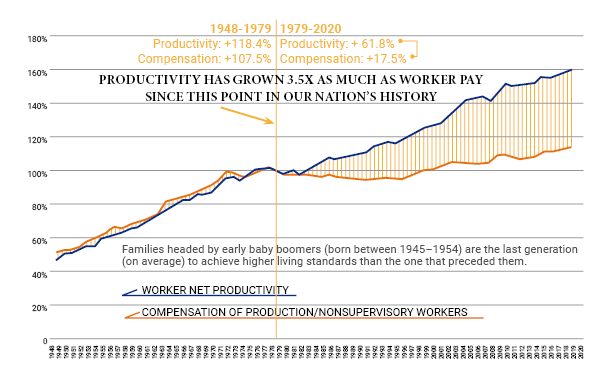

Productivity has grown 3.5 times as much as worker pay

Economic mobility is influenced by a variety of factors including education, neighborhoods, savings and family structure. Louisiana joins Oklahoma and South Carolina in a PEW Research study showing the worse economic mobility for their citizens than the national average on all three measures investigated.

Economic mobility is also fundamental to the American Dream. The ability to move up or down the economic ladder within a lifetime or from one generation to the next has been essential to the growth of the country.